Do our cities gather enough property taxes?

This is part two in a series on “Good City, Good Business.” If you missed part one, you can find that here. Like any business, cities generate revenue to pay for current costs of operation and for capital improvements. All these services and facilities have a cost, and some such as public safety and streets have enormous costs.

A city's methods for covering these costs varies widely from city to city. For many cities, property taxes comprise a large (or the largest) portion of their revenue stream. Surprisingly though, if we compare rates across other taxing jurisdictions such as school districts and municipal utility districts (MUDs), cities often have the lowest rates. However, no matter how low the adopted rate is, elected city officials feel constant pressure from citizens and state government to lower it further. Coupled with pressure to improve infrastructure and maintain a high level of service standards, elected city officials find themselves in a tight spot.

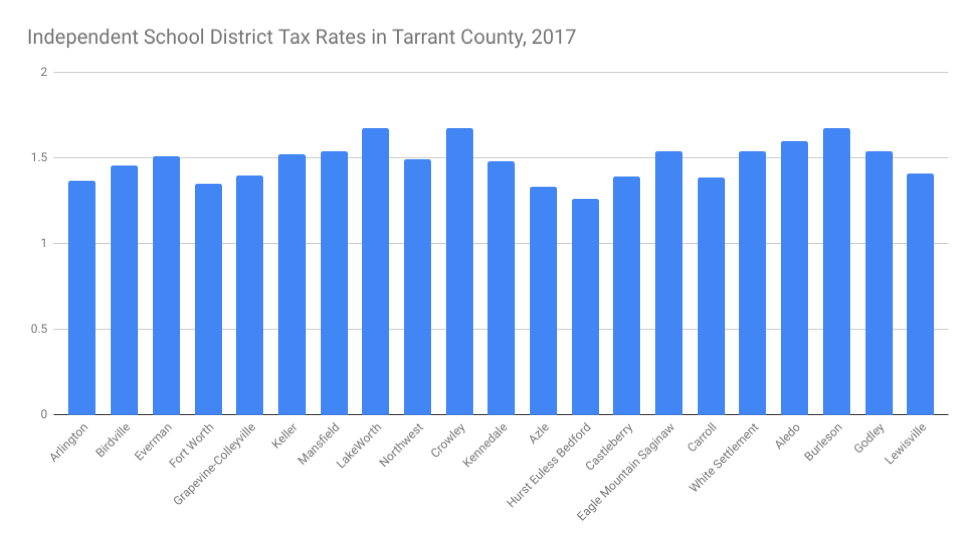

As an example let’s look at cities and school districts in Tarrant County, Texas for tax year 2017. In 2017, the cities of Tarrant County levied approximately $1,900 per acre in property taxes, while in that same year, school districts in Tarrant County levied approximately $3,600 per acre. Overall, cities in Tarrant County generated just over $962 million in property taxes, while school districts levied over $2.27 billion in property taxes. One can see the disparity easily enough by comparing property tax rates between the two types of jurisdictions.

This quick comparison doesn’t immediately allow us to say that we overfund school districts, or underfund cities. We haven’t established the cost of required services to determine whether one costs more than the other, or how much funding they each receive from other sources. However, we can safely conclude that school districts managed to establish much higher tax rates than cities, and operate with much higher revenues overall.

Municipal Utility Districts (MUDs): Cash Cows

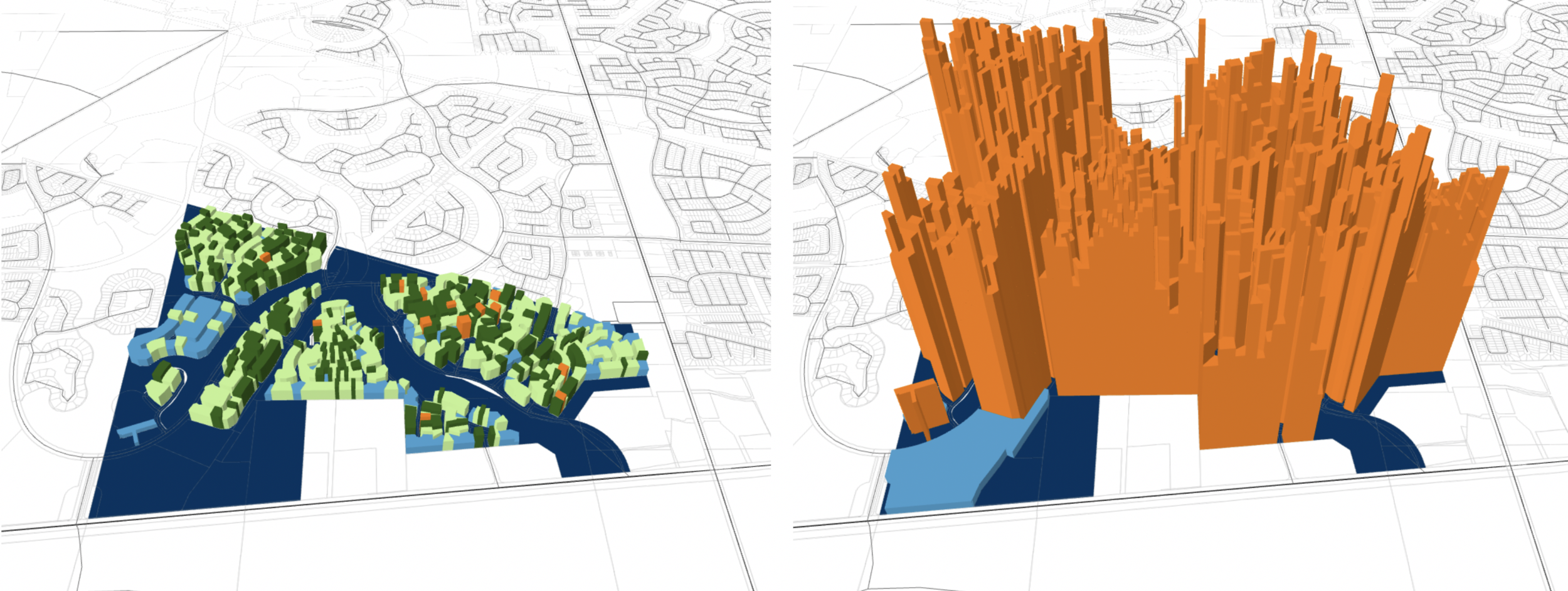

School districts are not the only jurisdictions with tax rates that over shadow city rates. Texas also has a growing number of Municipal Utility Districts (MUDs), especially along the gulf coast around Houston. In some cases MUDs have rates even higher than school districts and receive far less public oversight. We at Verdunity worked on a project recently illustrating the disparity between how much revenue one city in Fort Bend County generated compared to the MUDs covering the same neighborhoods. You can see some of the results below.

Neighborhood #1: Revenue to the City (left) vs. revenue to the MUD.

Neighborhood #2: Revenue to the City (left) vs. revenue to the MUD.

The above graphics show the disparity between revenue generation for two different neighborhoods in the same city in Fort Bend County, Texas. In the two neighborhoods combined, the City (left) generated approximately $785,000, while the the MUD (right) generated approximately $11,000,000. Citywide, residents paid $1.4 million in city taxes while paying over $16 million to the MUDs.

MUDs operate to reimburse developers the costs of installing the infrastructure needed to sell their development, and unlike municipalities, MUDs have no limits on how much debt they can issue. Most often MUDs originate outside city limits where no services currently exist.

A common sentiment regarding MUDs is that they make developments pay for themselves. A MUD can pay for streets, parks, water, and wastewater, but may not pay for all of those. Public safety usually comes from the City for in-city MUDs or from the County for MUDs outside city limits.

In the long run MUDs either raise more revenue to pay for continuing maintenance or the entire development gets annexed by a nearby city and that city takes over maintenance. Almost invariably, that city will operate at a much lower tax rate while providing more services.

Again, we can’t say that MUDs get overfunded based on this tiny data sample. However, the rate comparison should raise some interesting and important questions. Why do cities, which provide the same services as MUDs plus much more, operate with much smaller tax rates? Why don’t MUDs have the same debt caps and transparency requirements that we expect from cities? Any maybe most importantly, do MUDs offer us a more accurate picture of how much infrastructure and facilities actually cost when you account for long-term maintenance?

Growing Costs with Shrinking Revenues

It’s critical that we all understand our cities have large and growing cost burdens. Many cities in Texas have existing infrastructure installed in the '60s, '70s, and '80s, when suburban neighborhoods exploded across the state, that have surpassed its shelf life. In the majority of cities we’ve worked with, maintenance of infrastructure – especially residential streets – has not been accounted for and remains underfunded.

Additionally, the Texas Department of Transportation has been actively trying to unload roadways from their system onto cities so that the State doesn't have to pay for maintenance. The costs to provide police, fire, recreation and other services to current expectation levels is also steadily increasing.

At the same time, cities in Texas, on average, receive far less revenue from property taxes than school districts and MUDs. Some Texas cities also struggle with a yearly drop in their tax rates due to rollback requirements (despite cities’ rising costs). Furthermore, as if to pile on, cities in Texas face pending state legislation that would reduce and cap year-to-year property tax revenue increases from 8% to 2.5% per year.

My colleague Kevin recently interviewed city leaders from Bastrop, Texas, on our Go Cultivate podcast, and they discussed fiscal sustainability and the tension between available revenue sources and service demands. If you’re struggling to understand the pressure cities are under these days, give this episode a listen.

It’s great that we want development to pay for itself, but we need cities to pay for themselves. Largely, citizens have experienced a quality of life and level of service that far exceeds what they’ve paid for. Cities have begun to feel the true cost burden of maintaining or replacing streets, parks, utility infrastructure, and public safety services installed over the last 50 years. While government spending practices can improve, those improvements come nowhere close to making up the funding gap.

We may not like property taxes, but if we expect our cities to continue providing a certain level of services and infrastructure, we need to pay for it. If we don’t like property taxes as a method then we should explore other methods like a total fee structure or land value tax approach. Regardless of the method, we need to adjust our service and infrastructure expectations or become comfortable with ponying up the money to pay for what we demand.

No answers until we ask the right questions

I’m not saying we underfund education or MUDs. I am saying we don’t fund cities as much, and it’s important to ask why. We invest most in what we love most, and when people love their city then a great city becomes hard to avoid. Do we love our cities enough to make bigger investments in them? If we don’t, why not? Do you know how much of your property taxes go toward your city? Do you know if your city operates at a growing deficit?

At Verdunity we strive to ask tough questions, publish good data, and share best practices. We want to facilitate city leaders and citizens working together, and sharing a common understanding of the gaps between service expectations and existing funding. Most of all we want to help build lovable communities that people are ready, willing, and able to invest in.

Stay tuned for Part 3 in this series on The City as a Business, coming soon!